Entrepreneurship

Commercializing our cancer detection workflow

From the outset, our team was focused on providing value through our research. However, our interactions with stakeholders and clinical experts encouraged us to implement our workflow as an entrepreneurial venture. We decided that it was important to thoroughly execute on the steps of going from lab to market, keeping in mind technical specifications as well properly structuring our business.

To ensure that our values and our mission aligned with the needs of our stakeholders, our team interviewed cancer patients, healthcare professionals, and investors. After completing our interactions, we holistically assessed our interviews and the information that we had received in order to identify the primary pain points for the different stakeholder groups. We also used the information to form and revise needs statements based on each stakeholder’s collective needs.

From our consultations with 11 healthcare professionals (including diagnosticians, clinicians, academics) , we learned the deciding reasons to use a diagnostic test: (1) strong predictive value (high sensitivity and high specificity),(2) reasonable turnaround time, (3) ability to generate additional clinical insight, (4) capability for high throughput analysis; a secondary concern that emerged was the elimination of bisulfite sequencing. From interactions with patients, we saw that they also echoed the earlier sentiment for better doctor-patient communication. Patients were looking for a low-cost yet effective option that used non-invasive cancer detection. We realized that those impacted by hepatocellular carcinoma would greatly benefit from an early screening liquid biopsy test. We also spoke with investors from Sand Hill Ventures and Section 32.

After going through all our interactions, our team came together to craft a needs statement that accurately encompassed the major concerns. We subsequently deconstructed the needs statement to examine how our product and workflow were providing value, allowing us to construct a holistic value proposition. After affirming the technical basics, we performed market research and were able to identify our key competitors and how we believed that we would address the needs statement more effectively. We also created lifecycle use cases for our early clinical screening and post-therapy response implementations to demonstrate how each case essentially addressed the key points we had identified earlier.

To demonstrate key aspects of our minimum viable product (MVP), we demonstrated the validity of our machine learning algorithm, verification of key parts of the assay including the fluorescence quenching and microfluidic platform, and the screen flow for our digital health platform.

]

]

Finally, our team used the standard business model canvas to demonstrate how we were going to translate the value proposition into a profitable business. To tie everything together, we also got a testimonial from one of the investors that we had spoken with, Dr. Mike Pellini, former CEO of Foundation Medicine and VC at Section 32 in San Diego. Through our multiple interactions with Section 32 and Dr. Pellini, he was gracious enough to provide his perspective, saying the following:

“The Epinoma team clearly believes the ability to detect and assess a person’s cancer must continue to be improved. Their focus on epigenetics coupled with machine learning represents a novel approach in cancer diagnostics and may yield important advances for patient care. I commend the team for going well beyond a basic focus on technology development to understanding their stakeholders' needs and crafting their patient-centric vision accordingly. If they achieve this vision, Epinoma could have a meaningful impact on the patient care journey, from early screening to post-therapy response. Epinoma's long-term potential is enhanced by their push to develop a complementary digital health platform, which will be crucial in establishing broad base for commercial adoption, direct patient engagement, and a point-of-care opportunity down the road. I am truly impressed with what they have accomplished thus far in their young careers.”

Needs Statement

Developing a platform that uses highly accurate diagnostic methods and enhances patient-doctor communication with little difficulty for integration into existing clinical practices

Revised Needs Statement

Developing a platform that includes a highly accurate, non-invasive diagnostic method and embeds a digital health component that streamlines doctor-patient communication

Finalized Needs Statement

Developing an affordable, versatile clinical test for highly accurate, high-throughput, non-invasive cancer diagnostics without relying on chemical treatment analyses that embeds a digital health platform for streamlined doctor-patient communication.

From this, our team realized that our product needed to provide the following value:

Non-invasive detection

Epinoma looks for epigenetic determinants in circulating tumor DNA, avoiding the problems of tumor heterogeneity in tissue specimen analysis and incomplete tumor profiles from next-generation sequencing.

Reasonable price point

Compared to our competitors, we believe that we can offer an affordable price point of $250; recent reports indicate that our competitors charge as much as $4000/sample.

High predictive power

Our test has high levels of diagnostic accuracy, which is key for early adopters including patients and healthcare professionals.

Chemical-free analysis

Our Epinoma technology eliminates the need for bisulfite sequencing and has enhanced readout accuracy.

Versatility in application

Our workflow uses an in silico pipeline to determine specific biomarkers given the input data and the unsupervised machine learning algorithm can analyze any given set of methylome data, making it a modular framework for cancer applications.

Smartphone-equipped

Our secure, digital health platform exists the data into existing clinical practices and helps resolve a major point of concern and streamlines doctor-patient communication.

Market Analysis and Competition Analysis

The worldwide market for liquid biopsy was valued at $3.8 billion in 2017 and is expected to grow at a compounded annual growth rate (CAGR) of 10.1%. Part of this boost is due to the increasing interest in personalized medicine and high consumer preferences to non-invasive procedures. Early screening was expected to remain the most prominent use of liquid biopsy for years to come. For our product to successfully enter the market, we need to maintain a strong edge in innovation and demonstrate the standalone value of the individual components, including our biomarker discovery technology, our diagnostic assay, and the digital health platform.

SWOT Analysis

In order to assess the viability of entering the liquid biopsy space, our team considered internal and external factors in a SWOT analysis, which examined our strengths, weaknesses, opportunities, and threats.

Strengths:

- Strong intellectual property strategy that protects our overall workflow

- Takes a novel chemical-free approach that focuses on epigenetic determinants instead of structural modifications and should lead to higher accuracy

- Location in San Diego makes it very close to biotechnology resources and international connections with Mexico for future clinical testing

- Modular approach for variety of applications in different diseases

- Can be implemented at multiple points through the patient care journey, including screening and monitoring

Weakness:

- Still not 100% suitable for point of care as the workflow is best carried out in a clinical setting

- May be a more optimal genetic circuit that can allow for further signal amplification

- Lack of secure funding beyond the prototyping phase

- Applying synthetic biology to clinical diagnostics is a very new idea and may face resistance by potential adopters

Opportunities

- Growing interest in liquid biopsy space and non-invasive cancer detection techniques

- Widespread awareness about hepatocellular carcinoma and need for screening will help improve current five-year survival rate of 14%

- May relieve a major economic burden on current healthcare systems as post-therapy response will allow doctors and patients to develop more effective techniques before it is too late

Threats

- Competition from established industry giants such as Illumina/GRAIL and Guardant Health

- High initial costs due to research and prototyping as well as clinical trial administration

- Maximum success will only be achieved if plugged into the pharmaceutical pay model where they can develop drugs and molecules based on biomarker discovery

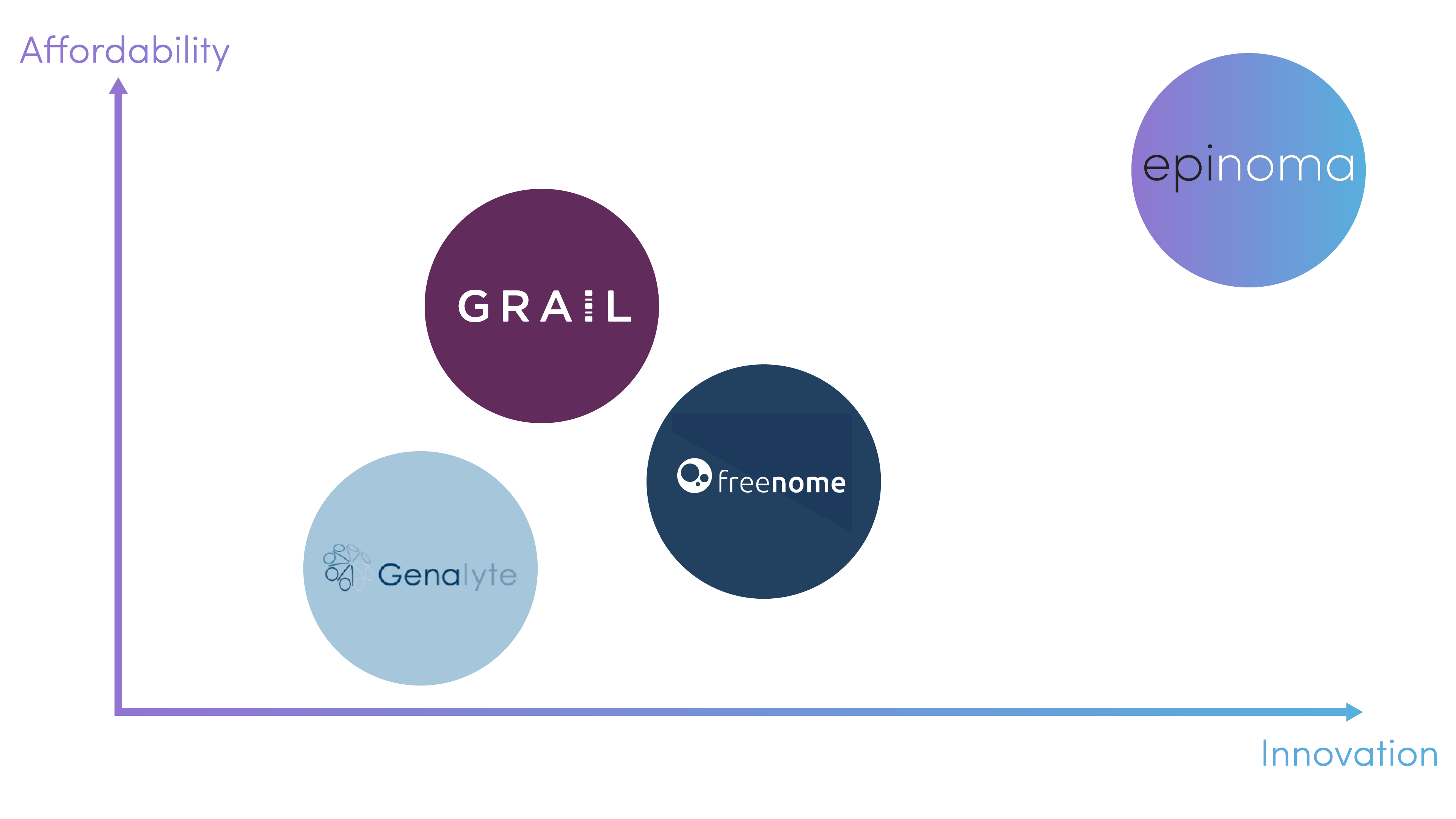

Competitor Landscape

(1) GRAIL - a spinoff from Illumina, GRAIL is focused on using a software-driven approach to accompany their NGS detection-based assays for circulating tumor DNA; one advantage that we maintain over GRAIL is that the company still uses whole-genome bisulfite sequencing to identify methylation patterns, leading to a decreased accuracy in readout and reliance on chemical treatment for results acquisition.

(2) Freenome - a startup that is focusing on harnessing AI in genomics to monitor real-time cfDNA levels, protein expression activity, etc.; Freenome is a strong competitor and harnesses AI in biomarker discovery and pattern realization as well, but the methods of methylation analyses again center around chemical treatment, which leads to reduced accuracy. In addition, our cost-analysis suggests that we will be able to offer our platform at a lower price point than Freenome

(3) Genalyte - although Genalyte does offer higher modularity, their price point is not reasonable for patients as well as the reimbursement systems. In addition, Genalyte does not look at epigenetic alterations as the key indicators of tumorigenesis, whereas research has demonstrated that looking at point mutations and genetic code alterations is less effective as a cancer diagnostics approach

Constructing Lifecycle Use Cases

Following our interactions with our stakeholders, we set out to determine if our product actually addressed many of the pain points that we had uncovered in our needs-finding stage. As mentioned earlier, we have two lifecycle cases: early screening and post-therapy response.

In addition to the traditional use case for novel diagnostics, our conversations with Dr. Eliasson allowed us to realize that Epinoma could have great value as a post-therapy response tool. This currently does not exist on the market and represents an exciting perspective for our workflow. We subsequently developed a lifecycle centered around post-therapy response.

Demonstrating our Minimum Viable Product and Future Committments

One of the crucial decisions that our team made was to segment each part of the workflow. We then demonstrated some form of validation for each aspect to demonstrate the success of our implementation. Although our actual product involves a diagnostic device, we are able to demonstrate validation for each part of our workflow

Because our product would be an in vitro diagnostic device, it must go through the CLIA (see below) regulatory approval cycle. As such, we are not allowed to demonstrate the validity of our solution on humans or human samples. Instead, our team has thoroughly documented the process on the wiki and has provided internal documentation as well. We also worked with clinical researchers in the UCSD Health System to develop a clinical protocol and envision what a kit, if implemented would consist of).

The first part of our workflow is the biomarker discovery tool. Our team analyzed 485,000 unique CpG sites to determine the optimal panel for biomarker detection. The data will be available upon request due to an agreement with UCSD, which hosts one of the United States' largest academic medical centers. After building our model (methodology is given on the Modeling page), we generated a receiver operating curve (ROC) that had an AUC value of 0.99 (highest possible value is 1, and we are the first team to our knowledge in the iGEM competition to have generated such a powerful epigenetics-based model with such high accuracy).

The second part of our workflow is the wetlab assay. Although all experimental results are explained in the Results section of our wiki, we can point to two points of validity: (1) the successful EMSA results of the HRP-MBD hybrid and (2) the statistical verification of the fluorescence quenching in our graphene oxide platform.

The third part of our workflow is the digital health platform to generate additional clinical insight. We have attached screenshots of the logical flow of this platform and the actual functionality that we believe is crucial to streamlining doctor-patient communication. This was developed with the insight of industry professionals such as the CTO of Roche, Matthias Essenpreiss, who emphasized the importance of striking a balance between data privacy and maximum utility.

Future Committments

Although not at the prototype stage, we are extremely pleased to announce that the TATA Institute of Genetics and Society will be awarding us a grant of $100,000 for 4 years to further refine our research before beginning user implementation.

Translating our value proposition and technological innovation

Customer Segments

Our customer segments include healthcare professionals (HCPs) who would be the primary users of our diagnostic assay and digital health platform. Additionally, cancer patients will also use our digital health platform to communicate with doctors and clinicians. Another one of our customer segments may include large pharmaceutical companies who may license our biomarker discovery tool in order to design more effective treatments going forward.

Value Proposition

As we have emphasized, the value of Epinoma is derived from the following qualities: non-invasive cancer detection, chemical-free analysis for input DNA samples, price point reduction, versatility in application, high sensitivity and specificity, and smartphone-equipped to streamline communication.

Channels of Distribution

Primary channels of distribution will be through doctors’ and clinicians offices and practices. We can also distribute our product through online channels including scientific websites and publications; to reach our target demographics, we will also build a network for word-of-mouth distribution through cancer and diagnostics conferences. This will allow us to reach out to early adopters and get their direct feedback

Customer Relationships

With healthcare professionals and administrators, we would be able to maintain a personal relationship in order to get early feedback on our tools and our overall platform. To create a business-to-business relationship, we would offer the opportunity to license our biomarker discovery technology for pharmaceutical companies. We would help patients interpret the results that would appear in our server and allow them to communicate with their doctor to chart out the next part of the diagnostics journey.

Key Resources

In order for our business to be successful, we need a capital-intensive lab space that will allow us to focus on streamlining our graphene oxide platform and testing additional signal amplification strategies. To get an initial testing pool, we will also rely on the strength of the UC San Diego Health System as a starting point.

Key Activities

Our key activities will be focused on: (1) further refining our biomarker tool for diseases that do not have existing methylome data, (2) further R&D work on the assay aspect, and (3) supply chain management with regards to furthering our traction in large medical centers.

Key Partnerships

In order for Epinoma to be fully functional, we must forge several partnerships: strategic alliances with the UCSD Office of Innovation and Commercialization and the UCSD Health System in order to provide a more centralized approach to gather and incorporate feedback. We must also partner with pharmaceutical companies by allowing them to license our technology for biomarker discovery and use that to develop effective treatments going forward. In the future, we also envision partnerships with Genentech and Roche to develop a large repository of healthcare and patient data that can benefit from our system .

Cost Structure

Our team will have initial costs including lab space rentals, lab space materials, CLIA waiver costs, intellectual property expenses, and administrative expenses

Revenue Stream

In order to generate revenue, we would (1) license our biomarker technology, (2) charge hospitals and healthcare providers $250 per sample (a ~70% reduction in price point), or allow individuals to use EDTA-stabilized tubes to directly mail in blood samples for same-day analysis, and (3) charge a monthly subscription fee for the Epinoma digital health platform that enables communication between other users and healthcare professionals, provides a month by month snapshot of hypermethylation profiles.

Business Plan and Pitch Deck

For other iGEM teams, we have also attached our business plan and pitch deck.