Since we feel NeuronArch is a promising project in the field of biotechnology and prosthetics, we envisioned it as a startup company and designed a business plan accordingly to the experience we had this year participating at iGEM.

Even though leg prosthetics are becoming more and more efficient and sophisticated, allowing amputees to even participate to Olympic Race, arm prosthetics have not evolved that much from the last century, usually equipped on the torso with a harness and not that much practical. While biomechanical prosthetics are slowly interring the market, bionic prosthetics are still missing because current technology do not allow a direct connection between the amputated limb’s nerves and the prosthetics itself. Osseointegrated prosthetics may be the field allowing this connection but the risk of infection by pathogenic biofilms on this type of interface is very high, requiring a heavy antibiotic treatment and removal of the osseointregrated prosthetic. To answer this problem, we used synthetic biology to create an engineered biofilm able to stimulate nerve regrowth after amputation but also reducing the risk of the formation of a pathogenic biofilm.

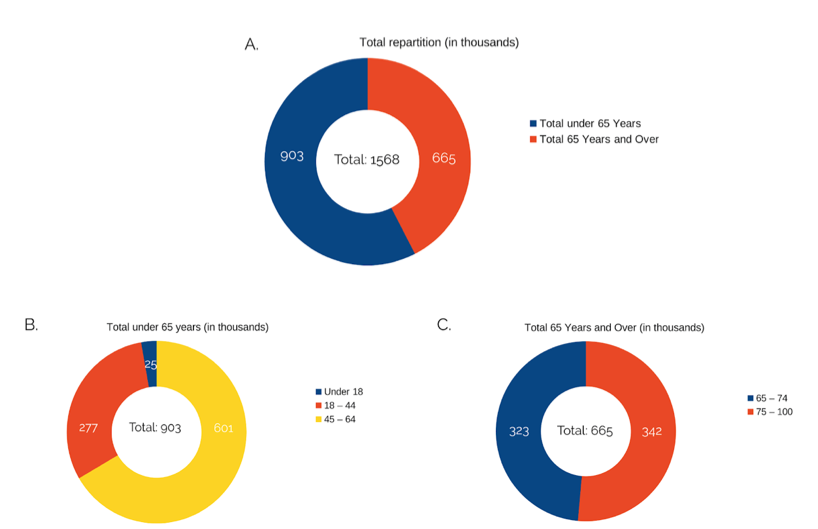

Before bringing NeuronArch to an industrial level, we first evaluated our target market, depending on the number of amputation and realized that our device, which would mainly be used by young/active people, was only a minority of the amputations. In fact, 57% of amputees [1] are under 65 years old, and in this group, 66.5% are between the age of 45 and 64 years old while only 30% are between the age of 18 and 44 years old (Cf. Figure 1).

However, the osseotintegrated implant market is expected to grow at a compound annual growth rate of 4% between 2013 and 2023 [2]. The global market for orthopedic prosthetics is expected to witness moderate growth rate in term of value owing to increasing incidence of trauma / accidental injuries (Cf. Table 1)

| Etiology and Age | 2005 | 2010 | 2020 | 2050 |

| Total | 1568 | 1757 | 2213 | 3627 |

| Dysvascular Disease Total | 846 | 969 | 1285 | 2272 |

| Dysvascular Disease with Comorbidity of Diabetes | 592 | 674 | 899 | 1667 |

| Trauma | 704 | 769 | 906 | 1326 |

| Cancer | 18 | 19 | 22 | 29 |

Introduction of custom-made implant products (rising demands for advanced orthopedic prosthetics, favorable reimbursement for orthopedic prosthetics, rise in prevalence of lifestyle related diseases and disorders, growing focus on containment of healthcare costs and distribution & collaboration agreements to increase product reach driving global revenues) is creating high potential growth opportunities for players operating in global orthopedic prosthetics market. Spur in the disposable household income in the emerging economies are expected to provide ample opportunities to the manufacturers operating in the osseointegrated implants market.

We feel our interface NeuronArch could respond to this demand, and tried our best to tackle every issue that comes with trying to bring NeuronArch to the industrial scale.

In the Business Plan, that you can download here, you will find a Market Analysis, Study of possible competition by private companies, our Marketing Plan, our Sales Plan, our Operations, details on our Company, as well as our Financial Plan.

REFERENCES

- Kathryn Ziegler-Graham, Ellen J. MacKenzie, Patti L. Ephraim, Thomas G. Travison, Ron Brookmeyer. Estimating the Prevalence of Limb Loss in the United States: 2005 to 2050, Archives of Physical Medicine and Rehabilitation (2008). Volume 89, Issue 3, Pages 422-429.

- Prescient Strategic Intelligence, “Osseintegration Implants Market” (2018) Retrieved Sep. 10th 2018 from https://www.psmarketresearch.com/market-analysis/osseointegration-implants-market